- Red Oak Independent School District

- 2024-2025 Budget and Tax Rate Presentation

- Tax Rate Notification

Business Services

Page Navigation

Tax Rate Notification

-

Tax Rate Notification

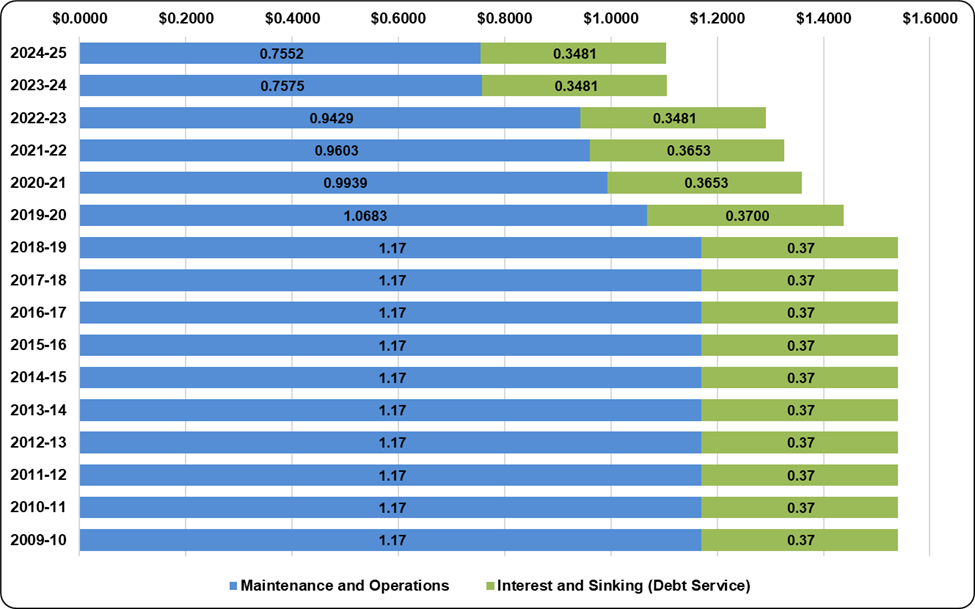

Public school tax rates are comprised of two (2) components. The first tax rate component is in the Maintenance and Operations tax rate (M&O) and helps fund the daily costs and recurring or consumable expenditures such as teacher and staff salaries, supplies, food, gas, and utilities. Approximately 85.7% of the District’s General Fund budget goes to teacher and staff salaries and benefits. The second tax rate component is the Interest and Sinking budget (I&S), also known as Debt Service, and this fund is only used to repay debt for longer-term capital improvements approved by voters through bond elections.

The Maintenance and Operations component includes two parts of the M&O tax rate. The first portion is Tier 1 and called the Maximum Compressed Rate (MCR) and is determined each year by the Texas Education Agency (TEA), based on certified property values. No district’s MCR can be below 90% of the State MCR. The Tier 2 portion is often times referred to as golden and copper pennies. The maximum Tier 2 tax rate is $0.17 and can only be accessed through a voter approval tax ratification election.

The 2024 Red Oak ISD M&O tax rate is $0.7552 and the I&S tax rate is $0.3481 for a total tax rate of $1.1033 per $100 of certified property value. The M&O tax rate is comprised of $0.6169 for Tier 1 (MCR) and $0.1383 for Tier 2. The table below shows the district’s tax rate for the last seven (7) years.

TAX YEAR

FISCAL YEAR

M&O

I&S

TOTAL TAX RATE

2024

2024-2025

$0.7552

$0.3481

$1.1033

2023

2023-2024

$0.7575

$0.3481

$1.1056

2022

2022-2023

$0.9429

$0.3481

$1.2910

2021

2021-2022

$0.9603

$0.3653

$1.3256

2020

2020-2021

$0.9939

$0.3653

$1.3592

2019

2019-2020

$1.0683

$0.3700

$1.4383

2018

2018-2019

$1.1700

$0.3700

$1.5400

Since the Red Oak ISD 2024 levy to fund maintenance and operations expenditures exceeds last year’s maintenance and operations tax levy due to only the increase in property values, by law the following statements must be included in the tax rate resolution adopted by the School Board relating to the impact of a home with a taxable value of $100,000.

THIS TAX RATE WILL RAISE MORE TAXES FOR MAINTENANCE AND OPERATIONS THAN LAST YEAR'S RATE.

THE TAX RATE WILL EFFECTIVELY BE RAISED BY 7.77 PERCENT AND WILL RAISE TAXES FOR MAINTENANCE AND OPERATION ON A $100,000 HOME BY APPROXIMATELY $58.70.

This change in the maintenance and operations tax rate is consistent with the House Bill 3 legislation passed in May 2019 in the 86th Legislative Session. Although the Red Oak ISD’s M&O tax rate has gone down by over 35.5% over the six (6) years, including the 2024 tax year, the overall property values in Ellis County have continued to go up due to more taxable property being developed and the escalation in the housing market. Under the Foundation School Program funding model, if the State certified taxable property values increase, the amount of state funding will decrease, but if the M&O tax rate decreases, the state funding may increase. If the District does not adopt the MCR tax rate approved by TEA, additional reductions in state funding will occur. In order to provide a balanced budget, based on the reduction in state funding, the voter-approved tax rate was adopted to maintain adequate funding for the 2024-2025 school year.

A sixteen (16) year history of the tax rates for the fiscal year is: